Retailers can meet consumers’ changing needs by re-examining their battery inventory mix.

As vehicle power demands increase with the addition of start-stop technology, infotainment systems and advanced safety features, the need for a cycling battery becomes more apparent. Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM) are better suited than conventional flooded batteries to meet the demands of today’s vehicles.

How Does My Inventory Compare to the Market?

Automotive aftermarket retailers want to provide their customers with numerous battery choices at various price points. At the same time, they need to balance the amount of space available to display that inventory. Making inventory adjustments will help retailers provide more tailored options for today’s consumers while minimizing inventory costs.

Most SKUs for automotive batteries are conventional flooded, with less than a quarter of inventory in cycling batteries. But the vehicles in operation (VIO) aftermarket “sweet spot” is 78 percent conventional flooded. If most of the SKU count is higher than the VIO, retailers will find themselves falling behind the curve.

What Changes Should I Make to My Inventory?

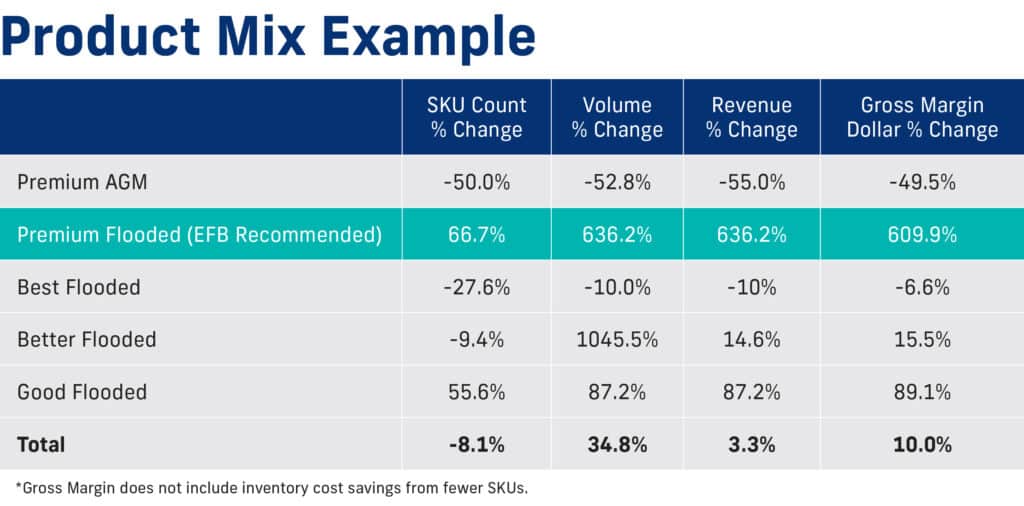

To align with the market shift, automotive retailers should consider shrinking the choices for conventional flooded and expanding inventory for cycling batteries. By adding more EFB SKUs, consumers will have more options that better meet their needs. This adjustment could also add revenue from the higher price point of the premium batteries.

Increasing EFB inventory meets the demand for consumers who own a start-stop vehicle that requires a cycling battery, positioning the retailer’s portfolio for the pending technology shift in the VIO. It also provides a better value for those consumers looking to trade-up from conventional flooded applications compared to what is currently offered.

Category management services help retailers determine the right inventory mix for their location. By utilizing data-driven insights, battery manufacturers monitor trends in retail battery sales and track patterns based on retail price, group size and grade level. With this data, manufacturers can advise automotive aftermarket retailers on whether their purchasing strategy aligns with current aftermarket trends. Retailers can then quickly adjust their product mix and adapt to market shifts when identifying growth in certain categories.

With aging and decline in the O.E. conventional flooded market, additional SKU reduction within the “Better” and “Best” grade levels while expanding the “Good” grade is recommended. Conventional flooded offerings are strategically placed within the grade levels to begin positioning the retailer’s offering in preparation for the continued growth of the cycling market. This change would result in an impactful percent reduction in SKUs, supporting increased category turns and lower inventory investment.

Stryten Energy experts made this hypothetical assortment recommendation based on an analysis of real industry data from S&P Global and the BCI Databook.

How Do These Inventory Changes Benefit My Company?

As retailers provide consumers with more options for their cycling battery requirements, such as EFB, there is potential to drive more traffic and sales. Retailers may also experience a higher conversion rate from the conventional flooded customer who is willing to trade up due to the price point and value proposition, driving more sales into the more profitable premium grade level. Grade-level mix change within the conventional flooded category could also drive more traffic and generate more unit volume.

The automotive aftermarket is shifting as vehicle power needs increase and start-stop technology becomes standard. Retailers can meet consumers’ changing needs by re-examining their inventory mix. Removing conventional flooded products related to aging vehicles that are late in their life cycle allows for the addition of cycling batteries such as EFB that fill gaps to increase volume and grow share.